Lifo Liquidation During July Laesch Company Which Use

LIFO matches the most recent. The replacement cost is expected to.

Chapter 13 Exam Docx Advanced Accounting Ii Chapter 13 Exam 1 Ridge Company Is In The Process Of Determining Its Reportable Segments For The Course Hero

Answer to LIFO LiquidationDuring July Laesch Company which uses a.

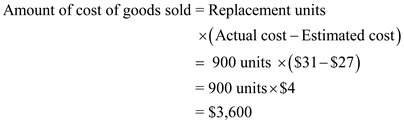

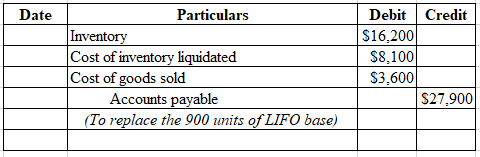

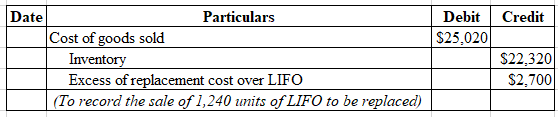

. LIFO liquidation causes distortion of net operating income and may become a reason of higher tax. Be 27 per unit. LIFO LIquIdatIonDuring July Laesch Company which uses a perpetual inventory system sold 1240 units from its LIFO-based inventorywhich had originally cost 518 per unit.

LIFO-based inventory which had originally cost 18 per unit. The replacement cost is expected to be 27 per unit. The replacement cost is expected to be 27 per unit.

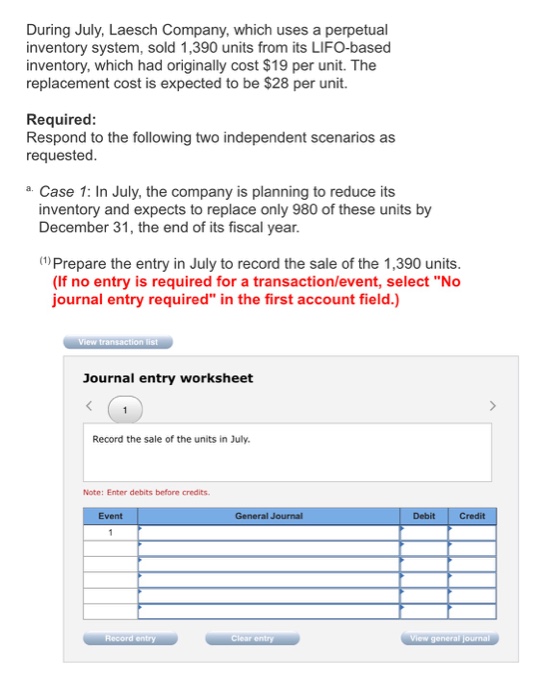

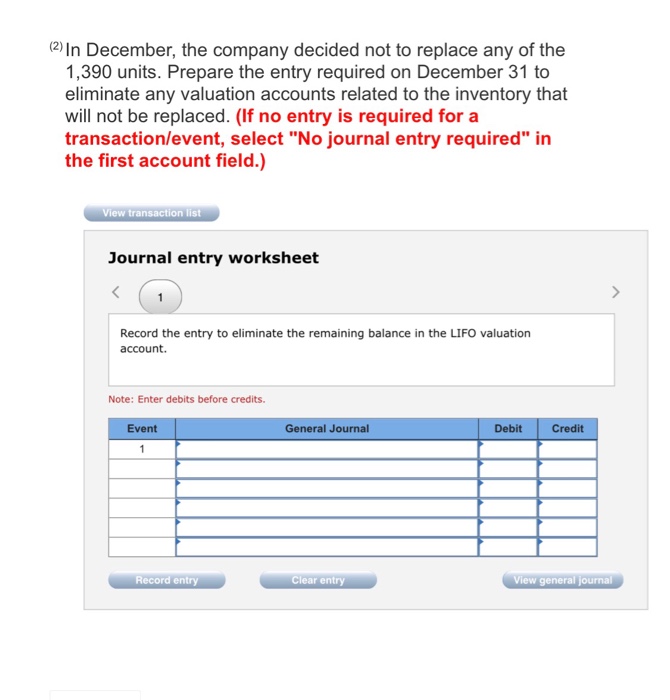

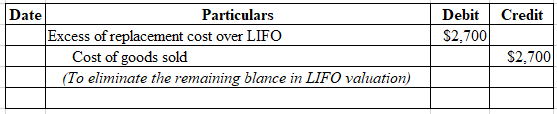

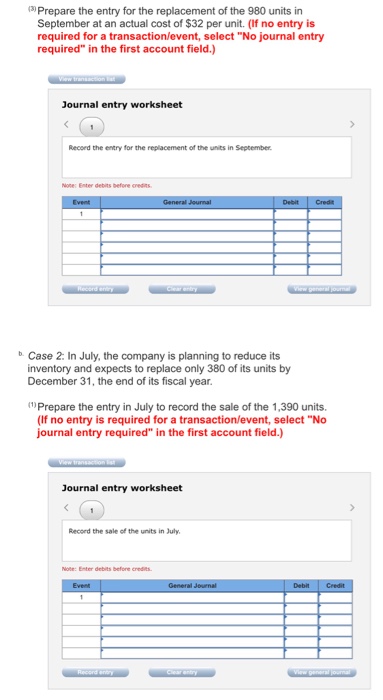

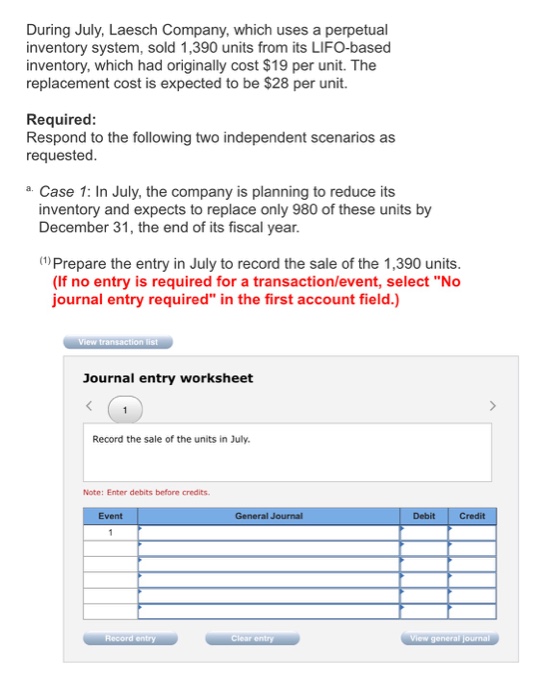

Respond to the following two independent scenarios as requested. A LIFO liquidation is when a company sells its newest inventory first. The replacement cost is expected to be 28 per unit.

Respond to the following two independent scenarios as requested. LIFO Liquidation During July Laesch Company which uses a perpetual inventory system sold 1240 units from its. The replacement cost is expected to be 30 per unit.

In July the company. Answer to E13-4 LIFO Liquidation LO 13-4 During July Laesch Company which uses a perpetual inventory system sold 1410 units from its LIFO-based inventory. View Chapter 13 Question 2pdf from ACCT 616 at Maryville University.

In other words it occurs when a company using LIFO method sells or issues more than it purchases. It is an accounting method that uses the last-in first-out LIFO inventory costing method. Please respond to the following two independent scenarios as requested.

LIFO liquidation refers to the practice of discount selling older merchandise in stock or materials in a companys inventory Inventory Inventory is a current asset account found on the balance sheet consisting of all raw materials work-in-progress and finished goods that aIt is done by companies that are using the LIFO last in first out Last-In. Required Please respond to the following two independent scenarios as. In July the company is planning to reduce its.

The replacement cost is expected to be 27 per unit. Laesch Company which uses a perpetual inventory system sold 1340 units from its LIFO-based Inventory whic originally cost 20 per unit. 9292020 Assignment Print View.

Last in first out LIFO is a method used to account for how inventory has been sold that records the most recently produced items as sold. 5 out of 500 points During July Laesch Company which uses a perpetual inventory system sold 1300 units from its LIFO-based inventory which had originally cost 16 per unit. E13-1 Reportable Segments Data for the seven operating segments of Amalgamated.

Definition of LIFO Liquidation. Respond to the following. Required Please respond to the following two independent scenarios as requested.

The replacement cost is expected to be 27 per unitRequiredPlease respond to the following two independent scenarios as requesteda. During July Laesch Company which uses a perpetual inventory system sold 1260 units from its LIFO-based Inventory which had originally cost 14 per unit. What is LIFO Liquidation.

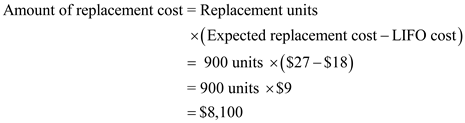

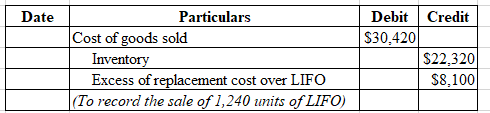

During July Laesch Company which uses a perpetual inventory system sold 1240 units from its LIFO-based inventory which had originally cost 18 per unit. LIFO Liquidation During July Laesch Company which uses a perpetual inventory system sold 1240 units from its LIFO based inventory which had originally cost 18 per unit. LIFO liquidation occurs when a company using LIFO inventory valuation method sells or issues the old stock of merchandise or raw materials inventory.

During July Laesch Company which uses a perpetual inventory system sold 1430 units from its LIFO-based inventory which had originally cost 16 per unit. LIFO Liquidation is an event occurring with the entities who are in the practice of using the LIFO Last in first out method method for cost of the inventories where the entity has to use older stocks acquired except the latest stock acquired due to a sudden increase in the market demand of the products and to full fill the demand the entity has to use. The replacement cost is expected to be 20 per unit Required.

Respond to the following two independent scenarios as requested a Caset in July the company is planning to reduce its inventory and expects to. View Ch13-Mahmoud Ahmed Abdel-Monemxlsx from ECONOMICS 101 at AlAzhar University in Cairo.

Required Respond To The Following Two Independent Scenarios As Requested 1 Course Hero

Su 21 Aa2 Wk2 C13wp Advanced Accounting 2 Week 2 Chapter 13 Weelky Problems Docx Su 21 Aa2 Wk2 C13wp Advanced Accounting 2 Week 2 Chapter Course Hero

Solved During July Laesch Company Which Uses A Perpetual Chegg Com

Required Respond To The Following Two Independent Scenarios As Requested 1 Course Hero

Su 21 Aa2 Wk2 C13wp Advanced Accounting 2 Week 2 Chapter 13 Weelky Problems Docx Su 21 Aa2 Wk2 C13wp Advanced Accounting 2 Week 2 Chapter Course Hero

Solved Lifo Liquidationduring July Laesch Company Which Uses A Chegg Com

Solved During July Laesch Company Which Uses A Perpetual Chegg Com

Su 21 Aa2 Wk2 C13wp Advanced Accounting 2 Week 2 Chapter 13 Weelky Problems Docx Su 21 Aa2 Wk2 C13wp Advanced Accounting 2 Week 2 Chapter Course Hero

Solved During July Laesch Company Which Uses A Perpetual Chegg Com

Solved Lifo Liquidationduring July Laesch Company Which Uses A Chegg Com

Su 21 Aa2 Wk2 C13wp Advanced Accounting 2 Week 2 Chapter 13 Weelky Problems Docx Su 21 Aa2 Wk2 C13wp Advanced Accounting 2 Week 2 Chapter Course Hero

Chapter 13 Exam Docx Advanced Accounting Ii Chapter 13 Exam 1 Ridge Company Is In The Process Of Determining Its Reportable Segments For The Course Hero

Solved Lifo Liquidationduring July Laesch Company Which Uses A Chegg Com

Required Respond To The Following Two Independent Scenarios As Requested 1 Course Hero

Solved Lifo Liquidationduring July Laesch Company Which Uses A Chegg Com

Su 21 Aa2 Wk2 C13wp Advanced Accounting 2 Week 2 Chapter 13 Weelky Problems Docx Su 21 Aa2 Wk2 C13wp Advanced Accounting 2 Week 2 Chapter Course Hero

Solved Lifo Liquidationduring July Laesch Company Which Uses A Chegg Com

Solved Lifo Liquidationduring July Laesch Company Which Uses A Chegg Com

Su 21 Aa2 Wk2 C13wp Advanced Accounting 2 Week 2 Chapter 13 Weelky Problems Docx Su 21 Aa2 Wk2 C13wp Advanced Accounting 2 Week 2 Chapter Course Hero

Comments

Post a Comment